What Is A Statement of Activities?

- May 17, 2022

- Uncategorized

- Posted by Antoine Watson

- Comments Off on What Is A Statement of Activities?

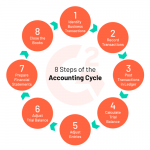

The nonprofit statement of activities is essentially a fund accounting report parallel to a for-profit’s income statement. Instead of measuring income, it focuses on providing detailed information about how the nonprofit uses its funding to advance the organization’s mission. Unlike for-profit companies, nonprofit organizations are not operating with the sole purpose of earning income. Instead, they operate to pursue their mission and continuously serve their constituents. This means that nonprofit financial reporting and management also differs from that of the for-profit world. The statement of activities reports the revenue, expenses, and net assets of the nonprofit.

Harming Investors and Helping Hackers: Statement on … – SEC.gov

Harming Investors and Helping Hackers: Statement on ….

Posted: Wed, 26 Jul 2023 17:50:13 GMT [source]

When implemented, it will create new information and will restructure much of the information that governments have presented in the past. We developed these new requirements to make annual reports more comprehensive and easier to understand and use. While nonprofit organizations are exempt from paying taxes, they still need to report their finances to the IRS on an annual basis. The tax form required by nonprofit organizations is known as the Form 990. The statement of functional expenses serves as an indicator of how effectively the nonprofit is allocating funds toward advancing its mission.

Open Liabilities sub menu

Return to the Internal Reports Introduction page for links to greater detail on how to read various reports as well as recommended formatting. To calculate the change in net assets, you subtract net revenue from net expenses. To calculate EPS, you take the total net income and divide it by the number of outstanding shares of the company. Shareholders’ equity is the amount owners invested in the company’s stock plus or minus the company’s earnings or losses since inception. Cash flows from investing activities include the purchase and proceeds of any investments, properties, or equipment. Contributions for capital acquisitions, trusts, and endowment, represents gifts designated for non-operating purposes such as capital projects, trusts, and endowments.

For those in a senior leadership role at a nonprofit, it’s important to acknowledge that these accounting statements tell a story. Those who read the statements use them to assess the performance of the nonprofit and ensure donor funds are wisely spent. Each statement, and any accompanying disclosures, convey all kinds of information, from the liquidity of the organization to the effectiveness of the fundraising team.

- Companies spread the cost of these assets over the periods they are used.

- Effective financial management for nonprofits has several challenging elements that must be taken into account.

- This report identifies funds received without donor restrictions and funds with donor restrictions.

- Contributions for capital acquisitions, trusts, and endowment, represents gifts designated for non-operating purposes such as capital projects, trusts, and endowments.

- You should review your statement of activities monthly to identify trends and changes.

You should look at your Statement of Activities every month and compare to previous periods. Identify trends and changes in sources of revenue, expenses, and changes to net assets. When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out. Current liabilities are obligations a company expects to pay off within the year. A company’s assets have to equal, or “balance,” the sum of its liabilities and shareholders’ equity.

Statement of Activities: Reading a Nonprofit Income Statement

A statement of activities is prepared every year to ensure that an organization has enough money to fund its projects. The report is essential for determining whether an organization can keep operating and has enough money to meet its obligations. You’re required by FASB 117 to report your expenses by functional classification, meaning you’ll need to at least split up your expenses by administrative, fundraising, and program expenses. This template provides a clear and organized way to present financial information, including revenues, expenses, and net change in financial position, by class, location, and project.

It breaks down each type of spending into specific details, such as credit card payments and employee salaries. This information can help you identify potential problems early on and solve them before they become larger financial issues. The expenses your organization incurs should all support your mission in some way, whether that’s by funding daily nonprofit operations or a specific project relevant to your mission’s purpose. Also included in your restricted revenue is temporarily restricted revenue. After that time elapses, they can be released from restriction and used as the nonprofit sees fit. These statements also show your nonprofit is staying compliant with financial regulations.

What are the key components of a statement of activities?

The first part of a cash flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income (as shown on the income statement) to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities.

The columns provide current period, last year and budget comparisons and variances. The year-to-date (YTD) columns can also be expanded to see the individual months that make up the YTD amounts. Although the primary report, there are other documents besides a statement of activities that are important for the financial health of a nonprofit. Documents such as your nonprofit statement of financial position, statement of cash flows, chart of accounts, and statement of functional expenses are all equally important.

Get our FREE guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances. Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances. Once you have the change in net assets, you can compare revenue and expenses by significant program activity (or function) to see exactly where you are making or losing money. Since functional expenses are a big theme for many investors, particularly the percentage of money you’re spending on programs, most nonprofit Statement of Activities are organized according to functional expenses.

Example Question #2 : Statement Of Activities

By understanding its contents, you’ll be better positioned to sustain your organization in the long term. By understanding how much money an organization has available and where the money is being spent, nonprofits can make informed decisions about their mission, operations, and future. Be sure to pay attention to the net assets available to your organization under the “without restrictions” column of your statement of activities when analyzing the document for sustainability. If you were to simply subtract the total expenses from total revenue without taking restrictions into account, you might have a false sense of security. When you examine your nonprofit statement of activities, it should be clear that the line items in the statement match up with those in your organization’s budget. This allows your organization to make sure you’re on track with your budgeted regular expenses.

You’ll need to record information about your organization’s expenses and revenue in your Form 990. Therefore, between your statement of activities and statement of functional expense, you’ll be all set to file your Form 990 each and every year. The purpose of the nonprofit statement of activities is to provide detailed information about zoho books review the organization’s transactions and how those activities help further the organization’s mission through various initiatives and programs. FASB Statement 117 allows most nonprofits to present their functional expenses in the notes of their financial statements, but these expenses may also be presented on the face of the statement.

Nonprofit Startup Myths: What Not To Believe

The second part of a cash flow statement shows the cash flow from all investing activities, which generally include purchases or sales of long-term assets, such as property, plant and equipment, as well as investment securities. If a company buys a piece of machinery, the cash flow statement would reflect this activity as a cash outflow from investing activities because it used cash. If the company decided to sell off some investments from an investment portfolio, the proceeds from the sales would show up as a cash inflow from investing activities because it provided cash. Showing budgetary compliance is an important component of government’s accountability. Many citizens—regardless of their profession—participate in the process of establishing the original annual operating budgets of state and local governments.

The “charge” for using these assets during the period is a fraction of the original cost of the assets. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Noncurrent assets are things a company does not expect to convert to cash within one year or that would take longer than one year to sell.

Contributions or gifts include outright cash gifts and pledges (promises to give) to the university. These contributions, including unconditional promises to give, are recognized as revenues in the appropriate categories of net assets in the periods received. The goal of a statement of activities is to determine whether an organization can fund its activities and if not, to pinpoint where changes can be made to increase revenue or decrease costs. The process of creating a statement of activities is not difficult and should not take long to complete. Talk to the accounting experts at Jitasa to gain a better understanding of your nonprofit statement of activities.

These statements are relatively consistent across different types of nonprofit organizations, although some nonprofits may be required to produce additional reports, statements, or disclosures. A Statement of Activities, also called a Profit & Loss Statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. The statement can be used to track the organization’s progress and make sure it is meeting its financial goals. To read and understand a nonprofit financial report, you first need to familiarize yourself with the Statement of Activities.