5 Reasons Why Investors Trade Bonds

- November 22, 2021

- Uncategorized

- Posted by Antoine Watson

- Comments Off on 5 Reasons Why Investors Trade Bonds

In reality, bonds are a widely traded asset that can strengthen your portfolio’s risk return profile and add diversification without exposing yourself to excessive volatility. Their supposed low reward is balanced by being a low-risk, safe option for investors, and their inverse relationship to interest rates also offers some profitable opportunities for trading bond CFDs. Trading bonds happens many thousands times a day and is an important part of global economic markets. The bond market is far bigger than the stock market and central banks conduct monetary policy in the bond markets. When buyers and sellers are trading their bonds, they dictate the yields of the various types of bonds they are trading.

- The easiest ways to buy bonds are through a broker, an ETF or directly from the U.S. government in increments of $100.

- To establish a Margin Agreement on an account, select Update Accounts/Features under the Accounts & Trade tab, and click Margin

and Options under Account Features. - When inflation is high, the dividends paid by shares and the fixed coupons paid by bonds both lose value in real terms – ie they have lower purchasing power.

- IG International Limited receives services from other members of the IG Group including IG Markets Limited.

- Investors can also add exposure to Treasuries through exchange-traded funds (ETFs) and mutual funds, which invest in a collection of government-backed bonds.

In addition, there is a difference in the settlement process. TreasuryDirect takes your payment on the day the securities are issued, which is usually several days after the auction date. Some online brokers, on the other hand, may require payment before the issue date. Bonds work by paying back a regular amount to the investor, and are referred to as a type of fixed-income security. A bond’s rate is fixed at the time of the bond purchase, and interest is paid to investors on a regular basis — monthly, quarterly, semiannually or annually — for the life of the bond. Fees are one con to bond mutual funds, but there’s also a higher level of risk that comes with this type of investing.

The Exciting World of Trading Treasury Bonds (Seriously)

The second additional element to add to your bond strategy is to first check the news and then the chart levels. But, not really many bond traders know what is actually going on behind the scene. The same type of action can often be seen on the bond price chart. When the bond matures the issuer repays the loan to the investor. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited.

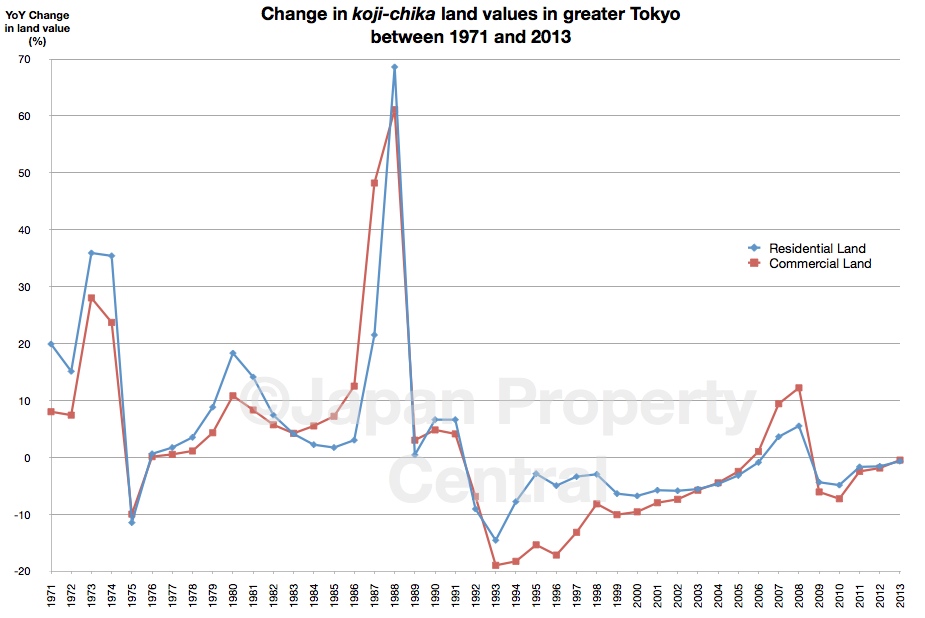

Corporate bonds are issued by corporations to fund a large capital investment or a business expansion, differing from corporate bonds in their sourcing but not their intent. The risk depends on the reputation and financial outlook of the issuing company. As the economy heats up, interest rates rise, depressing bond prices. As the economy cools, interest rates fall, lifting bond prices. You might think that bonds are a great buy during boom times (when prices are lowest) and a sell when the economy starts to recover.

How To Buy Bonds on the Secondary Market

Fixed income investments generally provide a return in the form of fixed periodic payments. On Fidelity.com, you can buy and sell secondary market fixed income securities such as bonds, or participate in new issue fixed income offerings. Buying individual bonds via your brokerage account is more complicated. Typically online brokers offer access to bond secondary markets, which means that availability and prices wholly depend on existing holders looking to sell. Owing to the inverse relationship between bond prices and interest rates – ie as interest rates rise, so bond prices fall, and vice-versa – bonds enable you to speculate on interest rate movements. With us, you can do this by taking a position in the government bonds futures market using CFDs.

The margin requirement for bond futures is set by the exchange and is subject to change at any time. Note that although the exchanges set the minimum margin requirements for futures, your broker may hold a higher margin requirement if it deems necessary. That’s because the bond costs less, while the interest rate remains the same as its initial offering. Conversely, when the price of a bond goes up, the effective yield declines. Term bonds usually offer a higher interest rate because of their unpredictable performance.

In most cases, you can also click Model a Hypothetical Trade to help you review the hypothetical impact of a trade on your overall portfolio. You can submit buy orders for New Issue Treasury, CD, GSE/Agency, and CorporateNotessm inventory. You can also submit an indication of interest to purchase new issue municipal bonds. See Participating in and Viewing New Issue Offerings for details.

You can buy T-bills online directly from the U.S. government at TreasuryDirect. Alternatively, you can also buy T-bills at auction or on the secondary market through a bank or broker. Some of the other ways to buy Treasuries include ETFs, money market accounts, and the secondary market. Many investors buy Treasuries for gifts and charitable transfers. You’ll also choose the product type or term, source of funds, and the amount to purchase. You can schedule the purchase whenever you like and how often you like, although dates are subject to availability.

Time for a Fresh Look at Long Bonds – See It Market

Time for a Fresh Look at Long Bonds.

Posted: Wed, 13 Sep 2023 21:13:48 GMT [source]

Alternatively, use our demo account to develop your trading skills and master our award-winning platform for free. 2 Because the demo simulates the live environment, you’ll be familiar with the platform when you create your live account.

The types of sovereign bonds you may encounter include agency bonds and savings bonds. Risks of sovereign bonds depend on the current exchange rate as well as the overall economy. If you’re interested in the bond market, check out Benzinga’s guide and learn the ins and outs of what is the benefit of economies of scale and use this activity to make the most of your investment portfolio.

Bond ETF Disadvantages

Bond ETFs are exchange traded funds that invest in fixed income securities. They can be passively or actively managed, and the fees are typically lower than bond mutual funds. Trading bonds can be a good option for those looking for more stable and predictable investments. However, it requires knowledge of the bond market and interest rates, as well as considering your investment goals and risk tolerance. Consulting a financial adviser can help determine if trading bonds is right for you. TradeStation is an online brokerage that offers a wide variety of investment products, including bonds.

A bond fund can be purchased through an investment company, an online broker or a financial advisor. Fixed-income investors use bond ladders to provide additional flexibility and adjust their holdings to changing market conditions. Treasury bonds aren’t offered on the secondary market by the government, but can be purchased https://1investing.in/ via brokerages. For corporate bonds, you’ll need to perform a price comparison for bonds you’re considering to make sure you’re comfortable with the spread a broker is charging prior to purchase. Bondholders often sell their bonds prior to maturity on a secondary market, where pricing is less transparent.

Sector-Rotation Trades

Conversely, a sudden deterioration in the economy and a rapid drop in interest rates could push futures higher, triggering limits on maximum losses and forcing basis trade exits. “The Fed is unlikely to view this accumulation of basis positions under too favorable a light and may eventually want to clamp down on them,” said Steven Zeng, U.S. rates strategist at Deutsche Bank. “However, the approach they take may not be straightforward as the Fed does not have direct regulatory oversight over hedge funds,” he said.

Like all debt instruments, bonds are heavily dependent on interest rates to determine their price. In general, interest rate hikes reduce the demand for bonds, as investors seek better interest rates elsewhere. In periods of decreased interest rates, the demand for bonds inversely increases, and their prices will rise. When you pull up /ZB on the Trade tab of thinkorswim, it pulls in the quotes for all the bond futures expiration dates, which are always in March, June, September, and/or December. The futures contract that’s most actively traded, which is usually the one with the most volume and shortest amount of time left to expiration, is conveniently marked “Active.”

If you are looking to save as much as possible on your trading costs, you can take a look at our best discount brokers. If you are new to trading and need as much guidance as possible, you might want to explore our best brokers for beginners. If you don’t have the time or skills to trade and want to copy trading signals, you could look for a social trading platform. Investors may choose to trade bonds for a number of reasons, with some of the key reasons being to try and make a profit, for protection and a way to diversify a trading portfolio. It is imperative that a trader has a clear understanding of what bonds are and why or why not they should trade them.

When you pull up /ZB on the Trade tab, you’ll also see plenty of Treasury bond futures options. The options will expire into, and are priced off, the futures contract with the corresponding expiration. For example, April, May, and June Treasury bond futures options expire into the June Treasury bond futures.

VT Markets, founded in 2015, is a global multi-asset CFD broker. Our mission is to build a next generation platform with superior trading environment for every trader across the globe. VT Markets is more than a platform, it is a place to capture market opportunities and achieve your own success. Now that you know the ins and outs of what bonds are and how they work, it’s time to cover how to trade bonds.

A corporate bond is a debt instrument issued by a business to raise money. Unlike a stock offering, with which investors buy a stake in the company itself, a bond is a loan with a fixed term and an interest yield that investors will earn. When it matures, or reaches the end of the term, the company repays the bond holder. Some corporate bonds are traded on the over-the-counter (OTC) market and offer good liquidity—the ability to quickly and easily sell the bond for ready cash.

If buying and selling Treasuries is important to you, many of the best brokerages offer free trading for Treasury bonds. You can also buy Treasury bills by investing in a Treasury money market mutual fund. Such funds typically have low fees and low yields limited by rates on the shortest-term Treasury bills. It is possible to buy Treasuries through ETFs at most brokerages.

Like other bonds, investors lend money to the issuer for a predetermined period of time. The issuer promises to pay the investor interest over the term of the bond (usually twice a year), and then return the principal back to the investor when the bond matures. Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. Investors should consider engaging a qualified financial professional to determine a suitable investment strategy.

Because our CFDs are issued off-exchange, you can deal in fractions of contracts. Davide Barbuscia covers macro investment and trading out of New York, with a focus on fixed income markets. Before joining Reuters in 2016 he worked as a journalist at Debtwire in London and had a stint in Johannesburg. It’s very understandable to be disappointed in bonds’ performance of late. The broad bond market had its worst year ever in 2022, as reflected by the AGG—the iShares Core U.S. Aggregate Bond ETF—which fell 13%.

Catastrophe Bonds Are Having a Moment. Here’s How to Play. – Equities News

Catastrophe Bonds Are Having a Moment. Here’s How to Play..

Posted: Wed, 13 Sep 2023 12:44:15 GMT [source]

The two most important risks for a bond investor are whether the bond’s issuer pays back the bond with interest and whether overall interest rates rise. If an issuer can’t repay the bond or rates rise, the bond will become less valuable. When the price of a bond declines, its yield — the percentage of its price that it pays to investors — goes up. For Treasury bonds, the federal government has set up a program on the Treasury Direct website so investors can buy directly without having to pay a fee to a broker or other middleman. A bond is a loan to a company or government that pays back a fixed rate of return.

A well-diversified portfolio should always strike a balance between stocks and bonds, helping you ride out volatility while still capturing growth along the way. Rates, terms, products and services on third-party websites are subject to change without notice. We may be compensated but this should not be seen as an endorsement or recommendation by TradingBrokers.com, nor shall it bias our broker reviews.

If your prediction is correct and bond prices fall, your profit on the trade would mitigate the loss to your other investments. Interest rate risk is the possibility of rising interest rates causing the value of an investment to fall. Fixed-income assets like bonds are exposed to this type of risk. If you hold bonds or shares in a bond ETF and expect to cut a loss owing to a hike in interest rates, you could hedge by going short on the government bonds futures market.

A debt security in a company with a high upside is enticing but remember that your bond portfolio must remain diverse if you want to protect yourself. A bond is a debt security issued by corporations and governments to raise funds. It is like borrowing money from someone, but instead of lending cash directly, the borrower issues a bond that obligates them to pay back the loan amount plus interest at a specified date in the future. Bonds are typically issued with maturities of more than one year. Interest payments on bonds are usually paid twice per year (semi-annually) until the bond matures.